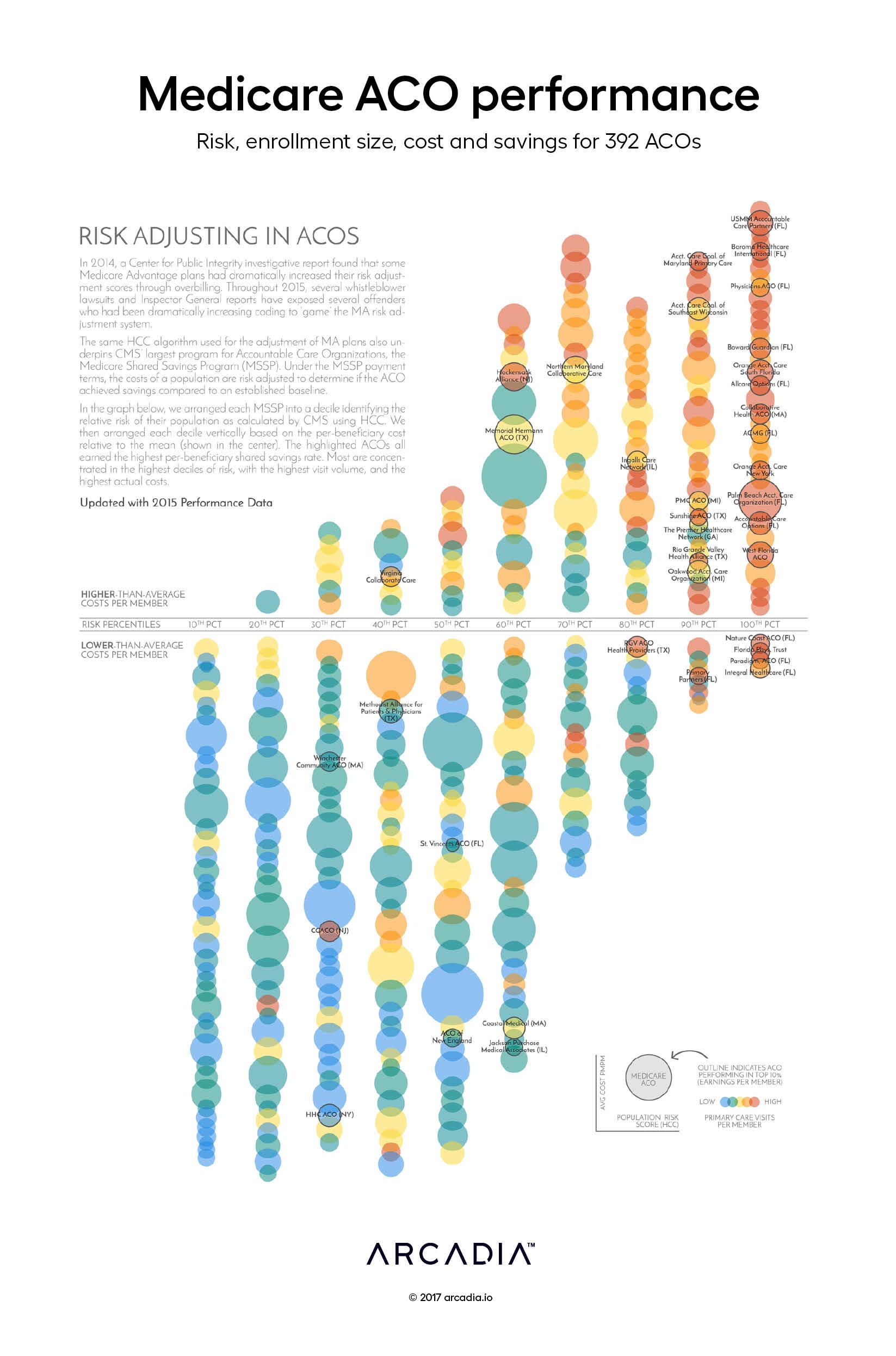

Medicare ACO performance

Risk scoring underpins many value-based payment programs. In the Centers for Medicare & Medicaid Services (CMS) Shared Savings Program (MSSP), risk adjustment is critical to the fair calculation of the savings rate and, ultimately, the success of the Accountable Care Organization (ACO).

CMS data on ACO performance

CMS makes MSSP ACO data available via a standard public-use file and an interactive tool. The most recent file contains data from the 2015 plan year. Our team used that data to look at the relationship of risk scoring to other factors like cost, size and access.

Reading the visualization

Each bubble represents an ACO.

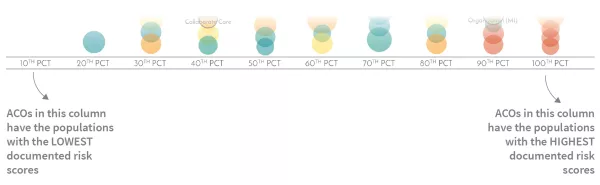

The ACO bubbles are arranged by decile corresponding to the relative aggregate risk score of their populations.

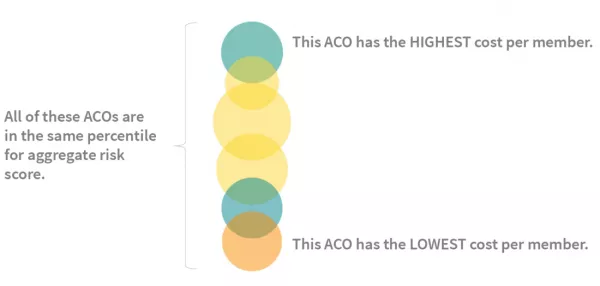

Vertically, the bubbles are arranged in order by cost per member.

The sizes of their relative populations are represented by bubble size. The color of each bubble reflects the per-member visit volume relative to the group, from blue (lowest) to red (highest).

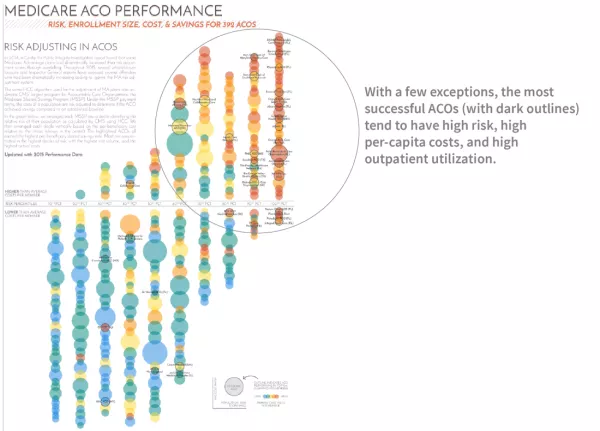

What do the most successful ACOs look like?

For this analysis, we are defining ACO success using the ACO’s earned savings rate adjusted by a quality modifier.

The most successful ACOs (with a dark outline) are noticeably clustered in the top 30% of identified risk, and are also the highest-ranked for per-capita costs and per-capital outpatient utilization.

What does it all mean?

Do more visits simply generate more coding leading to higher risk scores? Or do riskier populations need more services, and the risk score is accurately smoothing performance? The graph doesn’t explicitly provide an answer. However, MSSPs have the data to accurately predict where they might land.

Improving risk score documentation

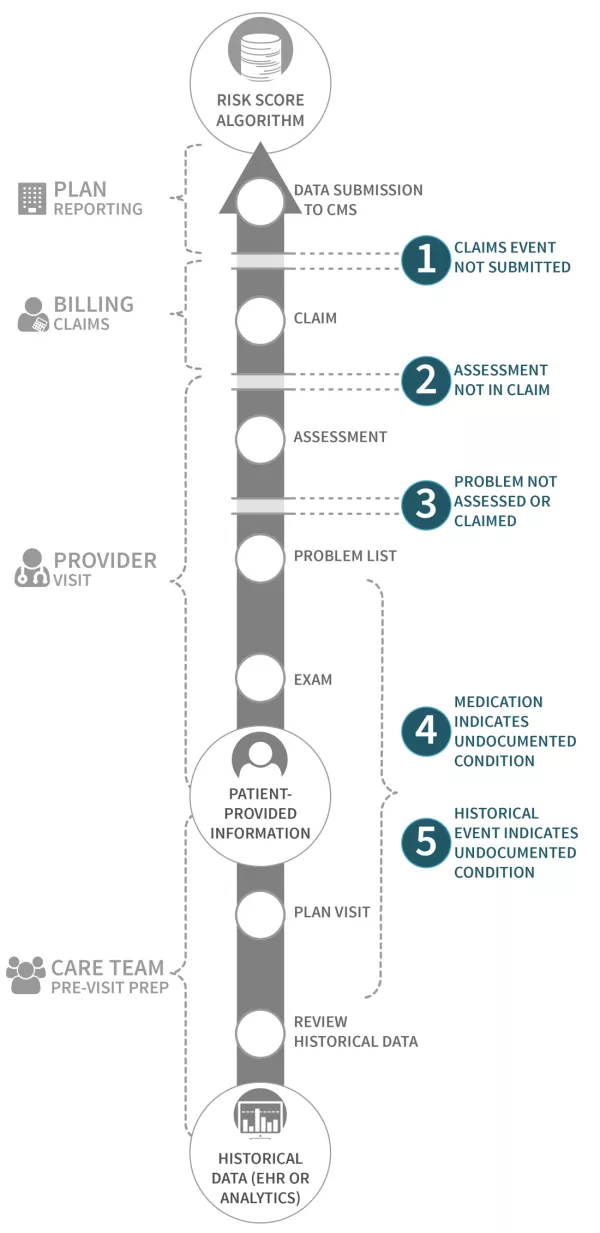

Understanding and documenting patient risk is key to providing appropriate services for that patient – and ensuring risk adjusted premiums are accurate. But data can be lost between pre-visit planning, the face-to-face-encounter, the creation of a claim, and the submission of data to a payer.

MSSPs receive fully-identified claims files that Arcadia uses to identify missed opportunities for improved risk scores based on clinical data. By highlighting these discrepancies, MSSPs see a more accurate representation of their population, as well as help care teams stay up-to-date on patient condition history.

Details

Excel, D3.js SVG, with Illustrator

Data sourced from 2015 CMS ACO Public Use File